A Deep Dive into the Mining Machine Distribution Network: Challenges and Opportunities

Cryptocurrency mining has evolved far beyond the solitary hobbyist plugging in a single rig in their garage. Today, the mining machine distribution network spans the globe, threading together manufacturers, distributors, hosting providers, and end users in a complex web of transactions and operations. This intricate system sustains the decentralized ledger technology that powers Bitcoin, Ethereum, Dogecoin, and countless altcoins. However, managing and scaling this network is fraught with both formidable challenges and promising opportunities, especially as new technologies, geopolitical shifts, and market dynamics come into play.

At the heart of the ecosystem lies the mining rig – the powerful hardware engineered to solve cryptographic puzzles that validate blockchain transactions. From ASIC miners optimized for Bitcoin’s SHA-256 algorithm to versatile GPU arrays catering to Ethereum’s Ethash, the landscape of mining machines is diverse and specialized. Mining rig manufacturers must balance cutting-edge performance, energy efficiency, and cost-effectiveness to stay competitive, while distributors grapple with the logistics of timely delivery amidst disrupted supply chains and soaring global demand.

Mining farms represent a leap beyond individual setups, housing thousands of rigs in large-scale data centers. These operations capitalize on economies of scale and access to cheap electricity, often in regions rich in renewable energy sources. For miners, the decision to invest in a hosting service versus maintaining equipment onsite involves weighing factors like cooling infrastructure, internet stability, and security. Hosting providers—specialists in operating mining farms—offer turnkey solutions that absorb operational headaches and ensure continuous uptime, crucial in the volatile crypto market where hash rate stability can mean the difference between profit and loss.

Bitcoin, as the pioneering cryptocurrency, still dominates mining discussions. The network’s hash rate, mostly driven by ASIC miners, reflects the health and security of the blockchain. But as Bitcoin transaction fees fluctuate and block rewards halve over time, miners increasingly consider mining other coins like Ethereum or Dogecoin to diversify revenue streams. Ethereum’s transition to a proof-of-stake consensus mechanism has dramatically impacted GPU mining demand, pushing miners to explore newer coins or liquidate rigs, thereby intensifying liquidity challenges within the distribution network.

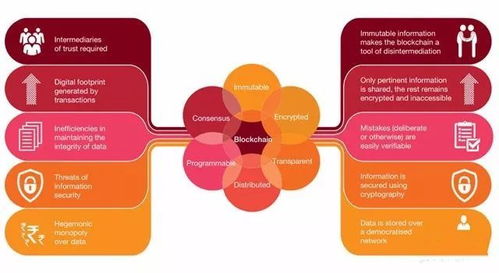

Adding complexity, exchanges have become pivotal nodes in the crypto economy, bridging miners’ cryptocurrencies to fiat markets and enabling swift asset swaps. Some platforms even provide integrated services that allow miners to hedge risks or immediately liquidate mined tokens. This interconnection highlights the importance of a seamless flow not just in hardware but in digital asset management. As mining machines and hosting services modernize, they increasingly intertwine with decentralized finance (DeFi), leveraging smart contracts and tokenized assets to innovate financing and asset management solutions.

Nonetheless, the mining machine distribution network faces mounting challenges. Supply chain bottlenecks—stemming from semiconductor shortages and geopolitical tensions—strain manufacturers and distributors alike. Regulatory landscapes are shifting uneasily; countries alternately embrace mining for economic benefit or clamp down on energy-intensive operations due to environmental concerns. Miners, particularly those running extensive farms, face the urgent task of integrating eco-friendly energy sources, balancing profitability against increasing electricity costs and carbon footprint scrutiny.

Conversely, these hurdles spark innovation and opportunity. The quest for greener mining solutions drives investments in renewable energy-powered hosting facilities and the development of energy-efficient mining rigs. Innovations in remote monitoring and AI-powered optimization offer mining operations unprecedented control and operational agility. Additionally, emerging markets with untapped renewable resources and supportive regulatory climates entice new mining farm establishments, diversifying the global distribution network.

In sum, the mining machine distribution network is at a pivotal crossroads. The relentless march of technology and fluctuating macroeconomic conditions challenge every stakeholder, from miner to manufacturer to hosting provider. Yet, this dynamic ecosystem continues to nurture cryptocurrency’s foundational promise: decentralized, secure, and transparent finance. For companies engaged in selling and hosting mining machines, embracing flexibility, sustainability, and integration with broader crypto infrastructure will be vital. The future will undoubtedly reward those who innovate through complexity and navigate uncertainty with strategic foresight.

This insightful article navigates the complex mining machine distribution network, exposing logistical challenges like supply chain disruptions and regulatory hurdles, while highlighting innovative opportunities in AI integration and sustainable tech— a refreshing, eye-opening analysis for industry disruptors!