Mining Machine Investment Profit Model

In the ever-evolving landscape of cryptocurrency, investing in mining machines has emerged as a tantalizing pathway to financial gains, blending cutting-edge technology with the volatile allure of digital assets. The mining machine investment profit model revolves around harnessing computational power to validate transactions on blockchain networks, thereby earning rewards in cryptocurrencies like Bitcoin (BTC). For novices and seasoned investors alike, understanding this model means delving into the mechanics of how these robust devices, often called miners or mining rigs, transform electricity and hardware into potential wealth.

At its core, the profit model hinges on the efficiency of mining operations. Picture a world where powerful machines hum in data centers, solving complex mathematical puzzles that secure networks such as Ethereum (ETH). Investors purchase or lease these mining rigs, which vary from compact home setups to industrial-scale behemoths, and deploy them to mine coins. The returns aren’t just about the cryptocurrencies mined; they include factors like electricity costs, hardware depreciation, and hosting fees. For instance, with BTC’s proof-of-work consensus, a single mining rig could yield fractions of a Bitcoin daily, but fluctuations in market prices can turn a modest operation into a lucrative venture overnight.

Yet, diversity in cryptocurrency choices adds layers of complexity and opportunity to this model. While BTC remains the flagship, with its capped supply driving value, altcoins like Dogecoin (DOG) offer lighter entry points and community-driven surges. Imagine shifting from BTC’s rigorous mining demands to ETH’s transition towards proof-of-stake, which might reduce the need for energy-intensive rigs but still rewards astute investors. This unpredictability—prices soaring on a tweet or plummeting amid regulations—infuses the model with burstiness, where one day’s profit can fund expansions into ETH staking or DOG mining farms.

Enter the realm of mining machine hosting, a service that epitomizes convenience for those wary of technical hurdles. Companies specializing in this provide state-of-the-art facilities, or mining farms, where investors can remotely manage their rigs without the hassle of noise, heat, or power bills. By outsourcing to these experts, users tap into optimized environments that boost uptime and efficiency, potentially amplifying profits from BTC, ETH, or even DOG. It’s a symbiotic setup: investors gain passive income streams, while hosts leverage economies of scale to keep operations running smoothly amidst market storms.

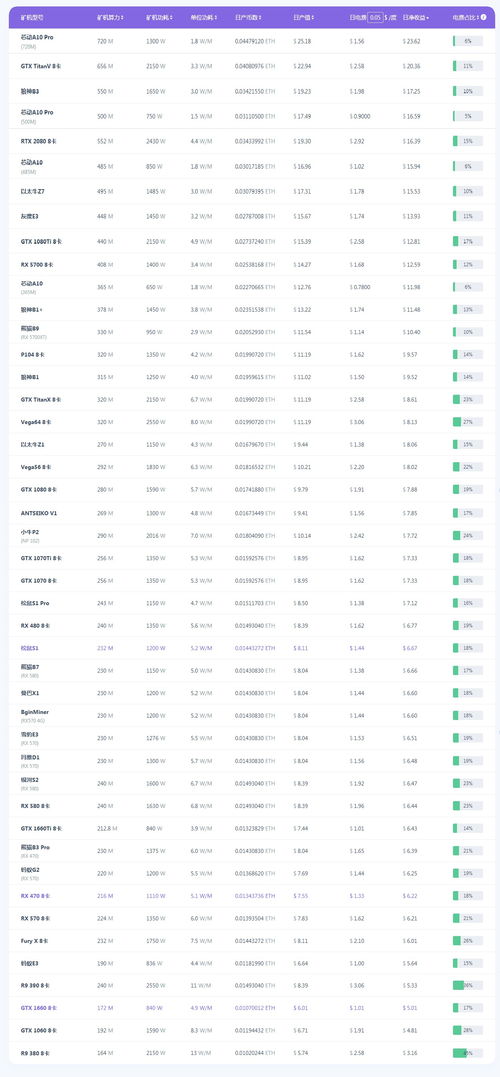

Delving deeper, the anatomy of a profitable mining rig involves selecting hardware that balances performance and cost. A top-tier miner might process transactions at breakneck speeds, outpacing competitors in the race for block rewards on networks like BTC or ETH. But beware the pitfalls—overheating, outdated tech, or a sudden DOGE pump could upend calculations. Investors must navigate exchanges to convert mined coins into fiat, all while monitoring global trends that dictate whether their setup yields steady gains or unexpected losses, creating a narrative as rhythmic as a heartbeat in a bustling trading floor.

In conclusion, the mining machine investment profit model is a dynamic tapestry woven from technological prowess, market intuition, and strategic foresight. Whether you’re drawn to the stability of BTC, the innovation of ETH, or the whimsy of DOG, success demands a blend of diversification and risk management. By partnering with hosting services and staying attuned to the pulse of mining farms, investors can craft a portfolio that not only withstands volatility but thrives on it, turning digital dreams into tangible rewards in this exhilarating crypto odyssey.

A deep dive into crypto mining ROI. Explores hardware costs, energy consumption, and volatile cryptocurrency prices. Crucial insights for navigating the complexities of profitable mining investments.